The Role of Fintech in Improving Financial Literacy in the Use of E-Wallets of UGJ Management Students in Cirebon City, 2025

DOI:

https://doi.org/10.38035/dijdbm.v6i3.4500Keywords:

Fintech, Financial Literacy, E-Wallet, Management StudentsAbstract

The rapid development of information and communication technology has brought significant changes in the financial sector, especially through Financial Technology (Fintech). One of the most popular fintech innovations in Indonesia is E-Wallet or digital wallet, such as DANA, GoPay, and ShopeePay. This study aims to analyse the effect of fintech and E-Wallet on students' financial literacy. Using quantitative methods and a comparative causal approach, this study involved 342 UGJ management students in Cirebon City as respondents selected based on the Slovin formula. Data processing was carried out using the SEM-PLS method to test the causal relationship between variables. The results showed that fintech has a significant effect on students' financial literacy, although with a relatively weak effect size (0.074). Meanwhile, the use of E-Wallets has a greater influence on financial literacy with an effect size of 0.240. However, the moderation of E-Wallet in the relationship between fintech and financial literacy does not prove significant. This indicates that E-Wallet directly contributes to improving students' financial literacy, while the role of fintech in general is still less strong. These findings provide important implications for academics, financial practitioners, and educational institutions to improve financial literacy through the use of E-Wallets and digital education. Campuses are advised to hold seminars and workshops related to more effective digital financial management. Future research is recommended to expand the scope of the study area, consider more E-Wallet platforms, and analyse the security and risk aspects of using E-Wallets.

References

Agarwal, S., & Zhang, J. (2020). FinTech, Lending and Payment Innovation: A Review. https://ssrn.com/abstract=3573248

Fadhila, A., & Marganing Utami, P. (2024). The Influence of E-Wallet Usage on Consumer Behavior in Purchasing Decisions. Undiksha Journal of Economic Education, 16(3), 2599–1426. https://doi.org/10.23887/jjpe.v16

Haryono, S. (2016). SEM METHODS FOR MANAGEMENT RESEARCH: AMOS, LISREL & PLS.

Klapper, L., & Lusardi, A. (2019). Financial literacy and financial resilience: Evidence from around the world. Financial Management.

Lusardi, A. (2019). Financial literacy and the need for financial education: evidence and implications. Swiss Journal of Economics and Statistics, 155(1). https://doi.org/10.1186/s41937-019-0027-5

Marpaung, O. (2021). THE EFFECT OF KNOWLEDGE OF FINTECH USAGE (OVO AND GOPAY) ON FINANCIAL LITERACY. Jayakarta Journal of Accounting & Taxation, 02(https://journal.stiejayakarta.ac.id/index.php/JAPJayakarta/issue/view/7).

Nenden Irawan, N., & Matoati, R. (2021). The Influence of Financial Literacy and Behavior in Using Fintech Payments on the Financial Management of Jabodetabek Students. The Management Journal Of Binaniaga, 06.

Nikmah, Y. Khoirun, & Dias Satria. (2024). ANALYSIS OF THE EFFECT OF E-WALLET USE ON CONSUMER BEHAVIOR (STUDY OF SOME OF EAST JAVA SOCIETY). Journal of Development Economic and Social Studies, 3(2), 599–608. https://doi.org/10.21776/jdess.2024.03.2.20

Partogi Situmorang, FJ (2024, June 13). Asia at the Forefront of the Digital Payment Revolution. https://Money.Kompas.Com/Read/2024/06/13/170000926/Asia-Terdepan-Dalam-Revolusi-Pembayaran-Digital.

Pusporini. (2020). THE EFFECT OF FINANCIAL LITERACY LEVEL ON FINANCIAL MANAGEMENT OF UMKM ACTORS IN CINERE DISTRICT, DEPOK. Journal of Applied Management Science JIMT, 2(1).

Retno Rahadjeng, E., & Hermawan, A. (2021). THE INFLUENCE OF FINANCIAL TECHNOLOGY ON THE FINANCIAL PERFORMANCE OF MSMES IN MALANG. Business and Accounting Research (IJEBAR) Peer Reviewed-International Journal, 5(4). https://jurnal.stie-aas.ac.id/index.php/IJEBAR

Reynaldy, B. (2024, July 24). 96% of Indonesian People Already Use E-Wallet. Https://Data.Goodstats.Id/Statistic/96-Masyarakat-Indonesia-Sudah-Menggunakan-E-Wallet-ItxIc.

Riska Hidayati, A., & Santyo Nugroho, D. (2023). Effect of Financial Literacy and Fintech Payment of Financial Management Behavior with Internal Locus of Control as Moderator. Journal of Business Management and Economic Development, 1(02).

Rizal, M., Maulina, E., & Kostini, N. (2019). FINTECH AS ONE OF THE FINANCING SOLUTIONS FOR UMKM. AdBispreneur, 3(2), 89. https://doi.org/10.24198/adbispreneur.v3i2.17836

Septyanto, D., & Praudy, NA (2022). PERCEPTION OF CONVENIENCE, ATTRACTIVENESS OF PROMOTION AND PERCEPTION OF USEFULNESS INFLUENCE ON PUBLIC INTEREST IN USING E-WALLET APPLICATIONS. Jurnal Keislaman, 5.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Ardelia Utami, Raudah Shakilla, Nurhana Parlina

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

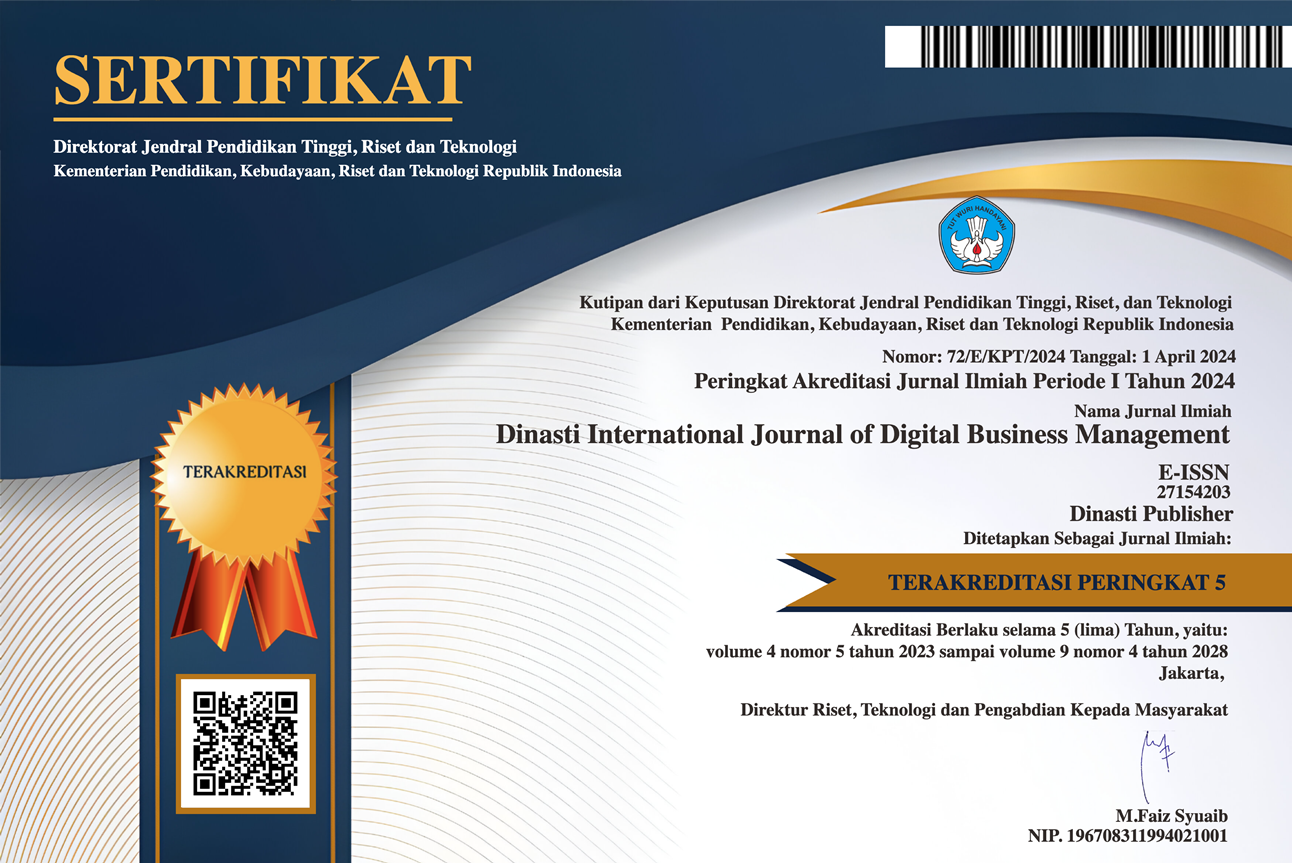

- The author acknowledges that the Dinasti International Journal of Digital Business Management (DIJDBM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Dinasti International Journal of Digital Business Management (DIJDBM).