Improving the Efficiency of the Personal Housing Loan Application Process through the Naval Service through Automation and Inclusive Socialization

DOI:

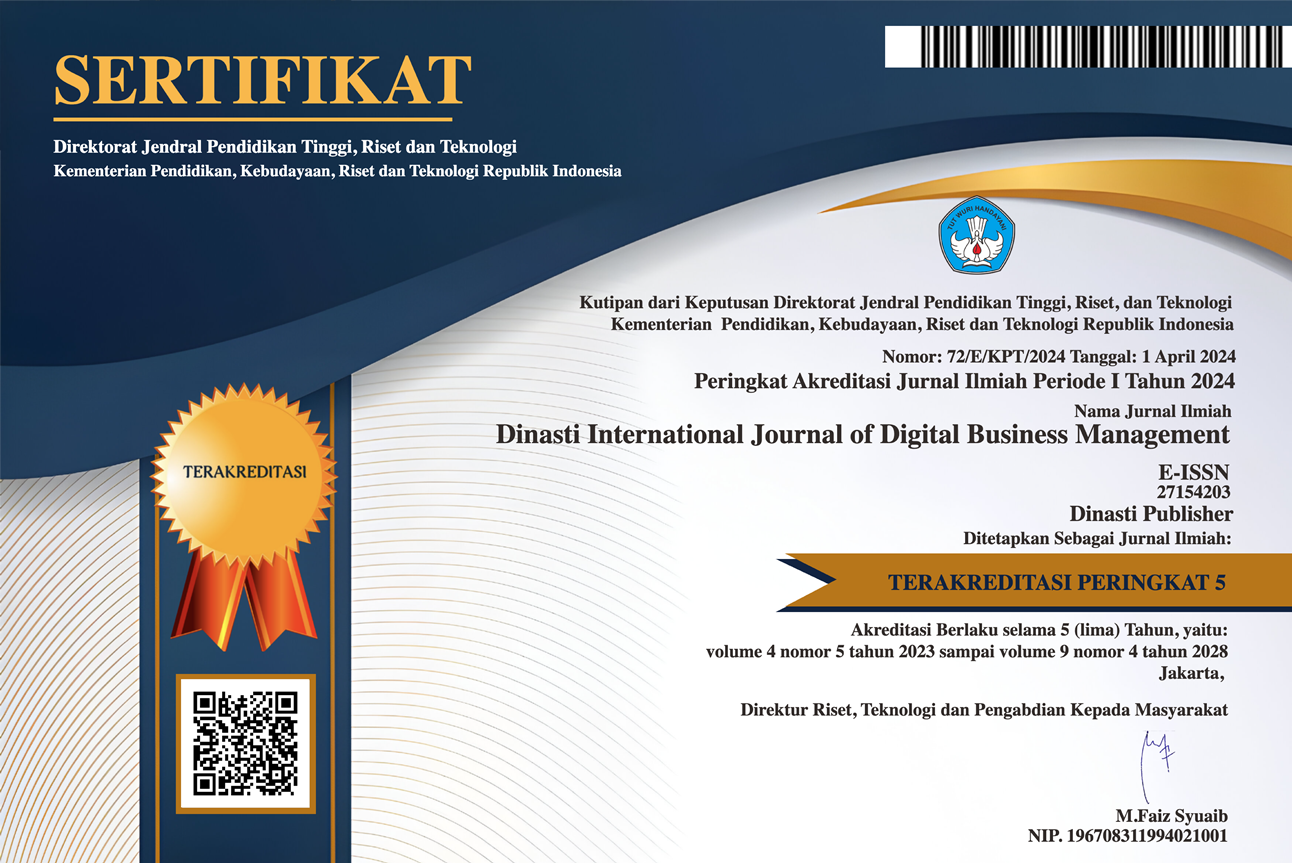

https://doi.org/10.38035/dijdbm.v6i2.4249Keywords:

automation, inclusive socialization, housing loans, TNI AL, service efficiencyAbstract

Efficiency in the process of applying for personal housing loans through the Indonesian Navy is a strategic step to improve member welfare. This study examines the implementation of automation of the loan application system and inclusive socialization as an effort to accelerate the administrative process, increase transparency, and expand access to information to all members, including those in remote areas. Automation allows for the digitization of document submission, data integration between departments, and automatic notifications that speed up the process and minimize uncertainty. Meanwhile, inclusive socialization through face-to-face training, online seminars, and internal media ensures members understand the procedures and benefits of the program. The results of the study show that the synergy between automation and socialization improves service efficiency, transparency, and member satisfaction with the loan program. This approach also builds trust and awareness that the program supports welfare without discrimination. With effective implementation, this strategy is expected to increase member motivation and loyalty to the institution, while strengthening the economic stability of their families.

References

Agarwal, S., & Mazumder, B. (2013). Cognitive Abilities and Household Financial Decision Making. American Economic Journal: Applied Economics, 5(1), 193–207. https://doi.org/10.1257/app.5.1.193

Alvionita, S. (2022). Sistem Informasi Pengajuan Pinjaman Kredit Usaha Rakyat (KUR) Pada Bank Rakyat Indonesia (BRI) Unit Sukarame. Ilmudata.Org, 2(2), 1–13.

Amadi-Echendu, A. P. (2014). Mortgage origination: Important lessons for south africa. Mediterranean Journal of Social Sciences, 5(10 SPEC. ISSUE), 45–51. https://doi.org/10.5901/mjss.2014.v5n10p45

Aritonang, S., Marsono, M., & Hutasuhut, M. (2019). Sistem Pendukung Keputusan Menentukan Kelayakan Pengajuan Pinjaman Modal Usaha Pada CU Solidaritas Karyawan Di Rs . Elisabeth Dengan Menggunakan Metode Fuzzy Tsukamoto. Jurnal CyberTech, 2(2), 443–455.

Asyahri, Y., & Ariyani, L. (2022). Analisis Keputusan Nasabah dalam Memilih Pembiayaan KPR di PT. Bank BTN Kantor Cabang Syariah Banjarmasin. Maqrizi: Journal of Economics and Islamic Economics, 2(2), 83–99. https://doi.org/10.30984/maqrizi.v2i2.279

Azahar, N. S., & Malek, N. M. (2023). Faktor- Faktor yang Mempengaruhi Kemampuan Pemilikan Rumah dalam kalangan Isi Rumah Bandar M40 di Pulau Pinang. Malaysian Journal of Social Sciences and Humanities (MJSSH), 8(3), e002182. https://doi.org/10.47405/mjssh.v8i3.2182

Barus, R. A., Elsera, M., & Hadinata, E. (2023). Analisis Penerapan Sistem E-loan Dan Prosedur Pemberian Kredit Kepemilikan Rumah (KPR) Dengan Metode Studi Kolerasional (Analysis of the Application of the E-loan System and Procedures for Providing Home Ownership Loans (KPR) Using the Correlational Study. JOURNAL OF COMPUTER SCIENCE AND INFORMATICS ENGINEERING (CoSIE), 02(2), 89–95. http://creativecommons.org/licenses/by-sa/4.0/

Chaiprasert, A., & Chongwatpol, J. (2023). Business intelligence and geographic information systems in the banking industry: A case study of home loan valuation. Journal of Information Technology Teaching Cases, 14(1), 90–107. https://doi.org/10.1177/20438869231155935

Defitri, D., Asriani, N., & Izha Lutfiyani, A. (2023). Home Ownership Loan Application Procedure (Kpr) Griya For Millenials (Gaul) At PTBank Pembangunan Jawa Barat dan Banten Tbk Kramatwatu. Review of Accounting and Taxation, 2(01), 59–71. https://doi.org/10.61659/reaction.v2i01.149

Farlina, Y., Yani, A., & Marsusanti, E. (2021). Sistem Informasi Pengajuan Pinjaman Pada Koperasi Simpan Pinjam Karya Nusantara Sukabumi. JUSTIKA?: Jurnal Sistem Informasi Akuntansi, 1(1), 10–17. https://doi.org/10.31294/justika.v1i1.254

Hermawan, F. F., & Yamasari, Y. (2022). Implementasi K-Nearest Neighbor dengan Pemilihan Fitur pada Aplikasi Prediksi Kelayakan Pengajuan Pinjaman. Journal of Informatics and Computer Science (JINACS), 3(04), 411–424. https://doi.org/10.26740/jinacs.v3n04.p411-424

Hernika, H., Isnaini, I., Pina, P., & Purnamasari, S. Y. (2023). Prosedur Pengajuan Pinjaman Kredit Usaha Rakyat (KUR) Pada Bank Sumsel Babel Capem KM 12. Jurnal Ilmiah Mahasiswa Perbankan Syariah (JIMPA), 3(1), 93–100. https://doi.org/10.36908/jimpa.v3i1.163

Kule, Y., Purnanengsi, L., & Amin, M. R. (2022). Implementasi Sistem Informasi Pinjaman Dana Berbasis Web Pada Koperasi Primadana Sari Luwuk Banggai. Jurnal Ilmiah Sistem Informasi Dan Teknik Informatika (JISTI), 5(2), 33–40. https://doi.org/10.57093/jisti.v5i2.125

Maranti, O. S., Ramdhani, L. S., Nugraha, R., & Rizal, K. (2018). Rancang Bangun Aplikasi Pengelolaan Pinjaman Koperasi Berbasis Mobile Pada Koperasi Pkk Sejahtera Sukabumi. Swabumi, 6(1), 72–77. https://doi.org/10.31294/swabumi.v6i1.3318

Nurqoidah, S., Lena, M., & Muhammad, H. (2017). Simulasi Aplikasi Setor Tunai Dan Pengajuan Pinjaman Pada PT. Bank BTPN. Jurnal Digit, 7(2), 137. http://jurnaldigit.org/index.php/DIGIT/article/view/91%0Ahttp://jurnaldigit.org/index.php/DIGIT/article/download/91/63

Nurrochim, A. F., Pangestu, E., Anam, M. R. A., & Hajar, I. (2023). Karakteristik rumah tangga dan akses keuangan dalam status penguasaan rumah. Journal of Advances in Accounting, Economics, and Management, 1(1), 1–5. https://doi.org/10.47134/aaem.v1i1.7

Ratu, T. F. H., & Bagus Wiksuana, I. G. (2023). Pengaruh Penilaian Kepribadian Dan Kapasitas Nasabah Terhadap Persetujuan Kredit Di Perusahaan Pembiayaan Home Credit. E-Jurnal Ekonomi Dan Bisnis Universitas Udayana, 12(01), 1592. https://doi.org/10.24843/eeb.2023.v12.i01.p06

Riswanto, I., & Laluma, R. H. (2020). Klasifikasi Kelayakan Pinjaman Pada Koperasi Karyawan Menggunakan Metode Naïve Bayes Classifier Berbasis Web. Infotronik?: Jurnal Teknologi Informasi Dan Elektronika, 5(1), 11–16. https://doi.org/10.32897/infotronik.2020.5.1.2

Safwan Harun, M., Haji Abdullah, L., & Karim Ali, A. (2020). ANALYSIS OF AL-DARURAH PRINCIPLES IN RIBA-BASED LOANS FOR THE PURPOSE OF HOUSE OWNERSHIP IN MUSLIM MINORITIES ANALISIS PRINSIP AL-DARURAH DALAM PINJAMAN BERASASKAN RIBA BAGI TUJUAN PEMILIKAN RUMAH DALAM KALANGAN MINORITI MUSLIM MUHAMMAD SAFWAN HARUN (Corr. 1(1), 149–163.

Sipayung, B., & Ardiani, A. (2022). Manajemen risiko dalam pertimbangan pengajuan pinjaman dana pemulihan ekonomi nasional (PEN) daerah. Kinerja, 19(4), 666–677. https://doi.org/10.30872/jkin.v19i4.12108

Syafi’i, M., & Bashori, D. C. (2020). Sosialisasi Produk Pinjaman Dan Investasi Online Ilegal Berdasarkan Penilaian Otoritas Jasa Keuangan (OJK) Pada Anggota Dasa Wisma Perumahan Alam Hijau Jember. Jurnal Pengabdian Masyarakat IPTEKS, 6(1), 48–54. http://jurnal.unmuhjember.ac.id/index.php/PENGABDIAN_IPTEKS/article/view/3731

Tangkelangi, A. R., Tumbel, R. E. C., & Mengko, S. K. (2016). Kesehatan hidung masyarakat di komplek perumahan TNI LANUDAL Manado. E-CliniC, 4(2). https://doi.org/10.35790/ecl.4.2.2016.14219

Tanjaya, W., Isnainul, O. K., Pakpahan, E. F., & Maggie, M. (2023). Tinjauan yuridis perbuatan melawan hukum atas suatu perjanjian kredit dengan jaminan suatu kepemilikan tanah yang belum terpisah dari sertifikat induk tanah (Studi Putusan Nomor 388 Pk/Pdt/2020). JPPI (Jurnal Penelitian Pendidikan Indonesia), 9(2), 1048. https://doi.org/10.29210/020231937

Voutama, A., & Rizal, A. (2023). [Retraction] Penerapan Forward Chaining Pada Sistem Pakar Pengendalian Internal Bank Pemberian Kredit Pemilikan Rumah. ILKOM Jurnal Ilmiah, 15(1), 201–214. https://doi.org/10.33096/ilkom.v15i1.839.201-214

Widyastuti, T., & Kurnianda, N. R. (2019). Perancangan Sistem Informasi Pengajuan Pinjaman Berbasis Web Menggunakan Metode Simple Additive Weighting. Jurnal Pilar Nusa Mandiri, 15(2), 219–226. https://doi.org/10.33480/pilar.v15i2.716

Wijhah, H. S., Ifna, R., & Susanty, D. (2021). Pengaruh Analisis Kredit pada Pinjaman Online terhadap Peningkatan Kebutuhan Pinjaman Masyarakat Dimasa Pandemi Covid19. YUME: Journal of Management, 4(2).

Yudianto, A. (2023). Persepsi Dan Pengetahuan Mahasiswa Tentang Pinjaman Online (Mahasiswa Stia Amuntai). SENTRI: Jurnal Riset Ilmiah, 2(12), 5142–5155. https://doi.org/10.55681/sentri.v2i12.1899.

Downloads

Published

Issue

Section

License

Copyright (c) 2025 Brian Winata Adi Saputra, Syamsunasir

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Dinasti International Journal of Digital Business Management (DIJDBM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Dinasti International Journal of Digital Business Management (DIJDBM).