An Analytical Review of Global Financial Market Dynamics: Risk Management Strategies and Monetary Policy

DOI:

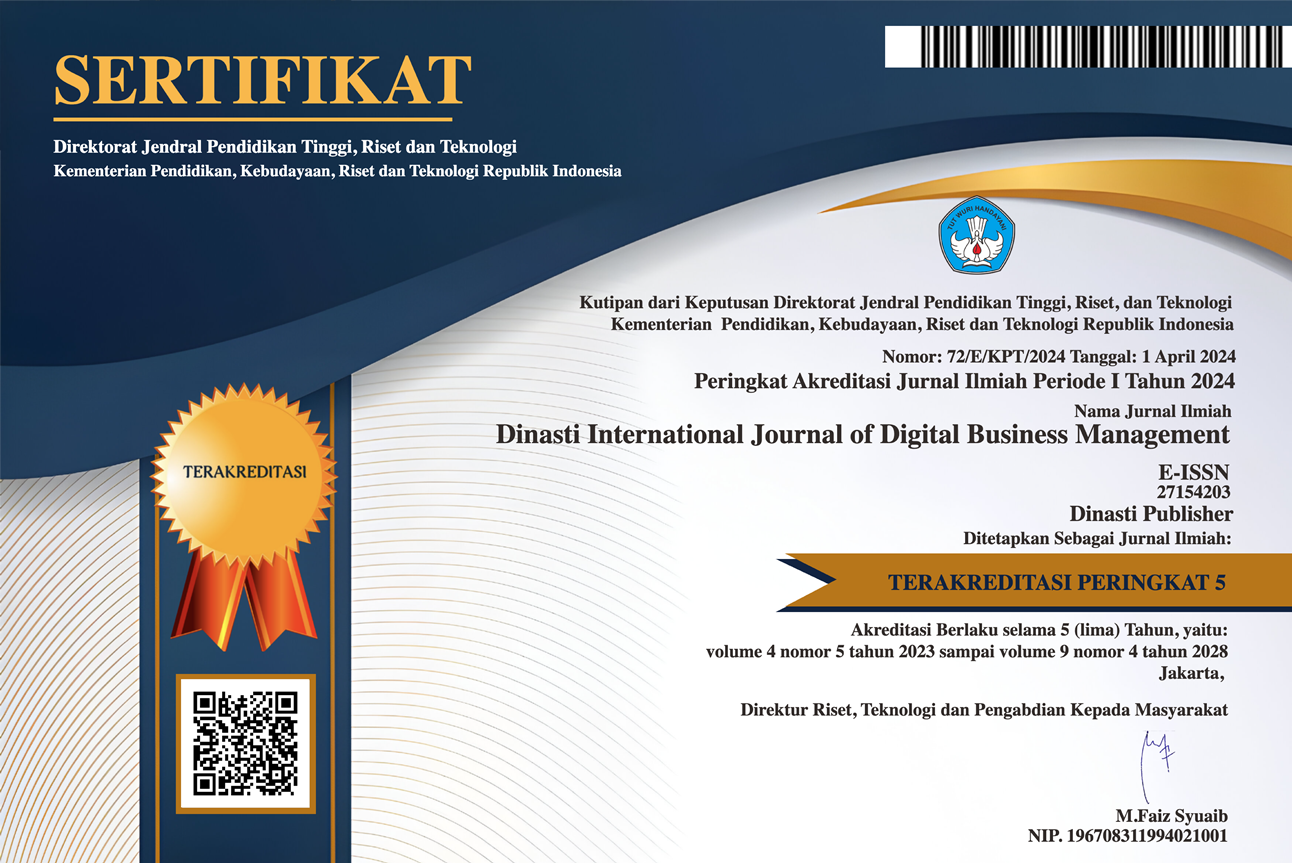

https://doi.org/10.38035/dijdbm.v5i6.3590Keywords:

Risk management strategies, monetary policy, financial marketAbstract

This study provides an in-depth analytical review of global financial market dynamics with a focus on risk management strategies and monetary policy. Through a thorough analysis of recent developments in financial markets, this study aims to understand the impact of economic, political, and technological factors on financial stability globally. The research pays particular attention to the risk management strategies employed by market participants, be they companies, investors, or financial institutions. Using an analytical framework, this research identifies various methods and instruments used in managing financial risks, including portfolio diversification, hedging, and derivative financial instruments. In addition, the research also analyzes the monetary policies implemented by central banks in different countries. The focus is on central bank responses to changes in economic and financial conditions and their impact on interest rates, inflation and economic growth. This analysis provides insight into how monetary policy can affect the stability of global financial markets. The results of this study are expected to provide a deeper understanding of the complex dynamics of global financial markets, assist market participants and policymakers in making more informed decisions, and provide a basis for the development of effective risk management strategies amid global economic uncertainty.

References

Agusmadi, A., & Marzuki, M. (2020). Analisis Model Korelasi Tanggung Jawab Sosial Perusahaan dan Nilai Perusahaan dalam Kondisi Krisis Pasar Keuangan Global 2020: Tinjauan dan Agenda untuk Penelitian Masa Depan. Jurnal Serambi Akademica, 8(4), 525-538.

Akbar, F. (2020). Manajemen Risiko Dalam Perbankan Syariah (Pasar Layanan Keuangan Yang Berkembang). Ekonomi, Keuangan, Investasi Dan Syariah (EKUITAS), 1(2), 111-119.

Fauzi, A., Damayanty, P., Pane, C. S., Julianti, E. A. C., Elok, G. P., & Rivai, I. (2023). Analisis Dampak Kebijakan Moneter Dan Tingkat Suku Bunga Terhadap Pertumbuhan Ekonomi. Jurnal Ekonomi dan Manajemen, 2(2), 50-58.

Firmansyah, M., & Mu’ammal, I. (2023). Efektivitas transmisi kebijakan moneter jalur kredit dan harga aset terhadap pertumbuhan ekonomi pada bank sentral di ASEAN-5. Entrepreneurship Bisnis Manajemen Akuntansi (E-BISMA), 378-396.

Indonesia, B. (2023). Tinjauan Kebijakan Moneter 2023. Jakarta: Bank Indonesia.

Prihartono, B., Annasthacia, G. A. P., & Fahlevi, F. (2023). Perancangan Strategi Pengelolaan Risiko Pemangku Kepentingan Berbasis Proses Bisnis pada PT X. J@ ti Undip: Jurnal Teknik Industri, 18(2), 120-129.

Rusiadi, B. E. (2023). Kemampuan Model CFA Dalam Memprediksi Transmisi Kebijakan Moneter Dan Stabilitas Inflasi Di Indonesia. Jurnal Minfo Polgan.

Supriyadi, E., & Sofiana, M. (2022). Analisa Manajemen Strategi Sistem Informasi Dalam Meningkatkan Pelayanan Menggunakan Metode SWOT (Studi Kasus PT XYZ). Jurnal Sistem Informasi, 11(1), 30-35.

Syamsia, J. D., Saerang, D. P. E., Maramis, J. B., Dotulong, L. O. H., & Soepeno, D. (2022). Kajian Konseptual Analisis Risiko Operasional di Perguruan Tinggi. Jurnal EMBA: Jurnal Riset Ekonomi, Manajemen, Bisnis dan Akuntansi, 10(2).

Yusri, C. R. (2023). Dampak Transmisi Kebijakan Moneter Terhadap Pertumbuhan Ekonomi di Sumatera Utara. Jurnal Riset Mahasiswa Akuntansi.

Downloads

Published

Issue

Section

License

Copyright (c) 2024 Rachmat Pramukty, Nera Marinda Machdar, Istianingsih Istianingsih, Sugeng Suroso

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

- The author acknowledges that the Dinasti International Journal of Digital Business Management (DIJDBM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Dinasti International Journal of Digital Business Management (DIJDBM).