Liquidity Surplus: Profitability Growth, Leverage, in Financial Service Companies

DOI:

https://doi.org/10.31933/dijdbm.v5i2.2310Keywords:

Liquidity, Probability, LeverageAbstract

The purpose of this article is to analyze potential strategies and solutions to efficiently manage liquidity surpluses, increase profitability, and address operational issues, and provide recommendations to company management on concrete steps that can be taken to optimize liquidity surplus management, increase profitability growth, and reduce leverage and gap risks in company operations. This article uses quantitative methods, which look for influences between variables, the population in this study is middle leaders in financial companies with respondents randomly selected from several financial companies with the distribution of questionnaires. The questionnaire returned after being filled out as many as 52 respondents. Data processing in producing results from questionnaires using SPSS 23 in producing research results.

Profitability and leverage have a significant influence on a company's liquidity. This suggests that a company's financial performance, such as profitability, and capital structure, such as leverage, play an important role in determining a company's liquidity level. Therefore, the company's financial management needs to pay close attention to these two factors in an effort to maintain and increase optimal liquidity levels. Pay Attention to Profitability Performance: The management of the company must continue to pay attention and improve its profitability performance. This can be done by improving operational efficiency, product innovation, and the right marketing strategy to increase company revenue and profits. It is expected that the company can maintain and increase its liquidity level, so that it can achieve its long-term financial goals more effectively and efficiently.

References

Agwu, E. M. (2020). Can technology bridge the gap between rural development and financial inclusions? Technology Analysis & Strategic Management, 33, 123–133. https://api.semanticscholar.org/CorpusID:225623543

Ayimah, J. C., Kuada, J., & Ayimey, E. K. (2023). Influence of Antecedent Beliefs on Digitized Financial Services Adoption among Customers in Rural and Semi-urban Towns in Ghana. African Journal of Innovation and Entrepreneurship. https://api.semanticscholar.org/CorpusID:259561396

Jangra, M. (2018). Working Capital Management- Sources & Its Effects On Profitability. Journal for Studies in Management and Planning, 4, 153–157. https://api.semanticscholar.org/CorpusID:170029807

Jihadi, M., Vilantika, E., Hashemi, S. M., Arifin, Z., Bachtiar, Y., & Sholichah, F. (2021). The Effect of Liquidity, Leverage, and Profitability on Firm Value: Empirical Evidence from Indonesia. Journal of Asian Finance, Economics and Business, 8, 423–431. https://api.semanticscholar.org/CorpusID:234224033

Kasradze, T. (2021). Emergence of Non-Traditional Financial Service Providers in the Market - A Threat or An Opportunity for the Georgian Banking Industry. European Journal of Marketing and Economics, 4, 94–106. https://api.semanticscholar.org/CorpusID:243836021

Krykliy, O. A., & Luchko, I. (2018). Model of Stress-testing of Banks’ Liquidity Risk in Ukraine. Financial Markets, Institutions and Risks. https://api.semanticscholar.org/CorpusID:169937235

Mardianti, A., & Sunandar, N. (2022). Influence of Liquidity, Profitability, and Leverage on Company Value. Proceedings of the International Conference on Economics, Management and Accounting (ICEMAC 2021). https://api.semanticscholar.org/CorpusID:246952343

Moridu, I., & Abidin, Z. (2023). Adapting Financial Management Strategies Amidst Economic Turmoil: A Case Study of Gama Corporate’s Liquidity and Restructuring Initiative. The Eastasouth Management and Business. https://api.semanticscholar.org/CorpusID:263321640

Mughal, S. L., & Saeed, M. A. (2014). A detail analysis on the relationship between Group’s diversification into the financial services industry and its impact on their financial performance. Research Journal of Finance and Accounting, 5, 126–145. https://api.semanticscholar.org/CorpusID:55741300

Nieuwoudt, R., & Hall, J. H. (2022). Impact of Firm-specific Attributes on the Shareholder Value Creation of Listed South African Companies. Global Business Review. https://api.semanticscholar.org/CorpusID:252516840

Njenga, R. (2019). BOARD CHARACTERISTICS, FIRM SIZE AND FINANCIAL LEVERAGE OF MANUFACTURING FIRMS LISTED AT NAIROBI SECURITY EXCHANGE, KENYA: THEORETICAL REVIEW. https://api.semanticscholar.org/CorpusID:221148035

Njeri, W. R., Namusonge, G. S., Mugambi, F., & Jomo. (2017). Effect of Resource Utilization on Financial Sustainability of Government Owned Entities in the Ministry of Agriculture, Livestock and Fisheries (MOALF), Kenya. https://api.semanticscholar.org/CorpusID:235399397

Prakosa, D. J., & Muharam, H. (2022). The Influence of Liquidity, Firm Size and Profitability on Company Value Mediated By Leverage of Companies Listed on IDX. International Conference On Research And Development (ICORAD). https://api.semanticscholar.org/CorpusID:255289402

Putri, O. D., & Wiksuana, I. G. B. (2021). THE EFFECT OF LIQUIDITY AND PROFITABILITY ON FIRM VALUE MEDIATED BY DIVIDEND POLICY. https://api.semanticscholar.org/CorpusID:235375494

Rom?nova, I., Grima, S., Spiteri, J., & Kudinska, M. (2018). The Payment Services Directive II and Competitiveness: The Perspective of European Fintech Companies. EUROPEAN RESEARCH STUDIES JOURNAL. https://api.semanticscholar.org/CorpusID:169065561

Sa’diah, N. H., Manik, E., & Danasasmita, W. M. (2023). Effect of Liquidity and Profitability on Company Value. Acman: Accounting and Management Journal. https://api.semanticscholar.org/CorpusID:258826466

Stefanie, S., & Yanti, Y. (2023). THE IMPACT OF LIQUIDITY, PROFITABILITY, AND LEVERAGE ON FIRM VALUE WITH DIVIDEND POLICY AS MODERATING VARIABLE. International Journal of Application on Economics and Business. https://api.semanticscholar.org/CorpusID:264989526

Yuliyanti, L., Waspada, I., Sari, M. P., & Nugraha, N. (2022). The Effect of Liquidity, Leverage, and Profitability on Firm Value with Firm Size as Moderating Variable. Proceedings of the 6th Global Conference on Business, Management, and Entrepreneurship (GCBME 2021). https://api.semanticscholar.org/CorpusID:251145204

Downloads

Published

Issue

Section

License

Copyright (c) 2024 Siska Yuli Anita, Nuraeni Nuraeni, Moch Arif Hernawan, Siti Nurhayati, Enny Haryanti

This work is licensed under a Creative Commons Attribution 4.0 International License.

Authors who publish their manuscripts in this journal agree to the following conditions:

- The copyright on each article belongs to the author(s).

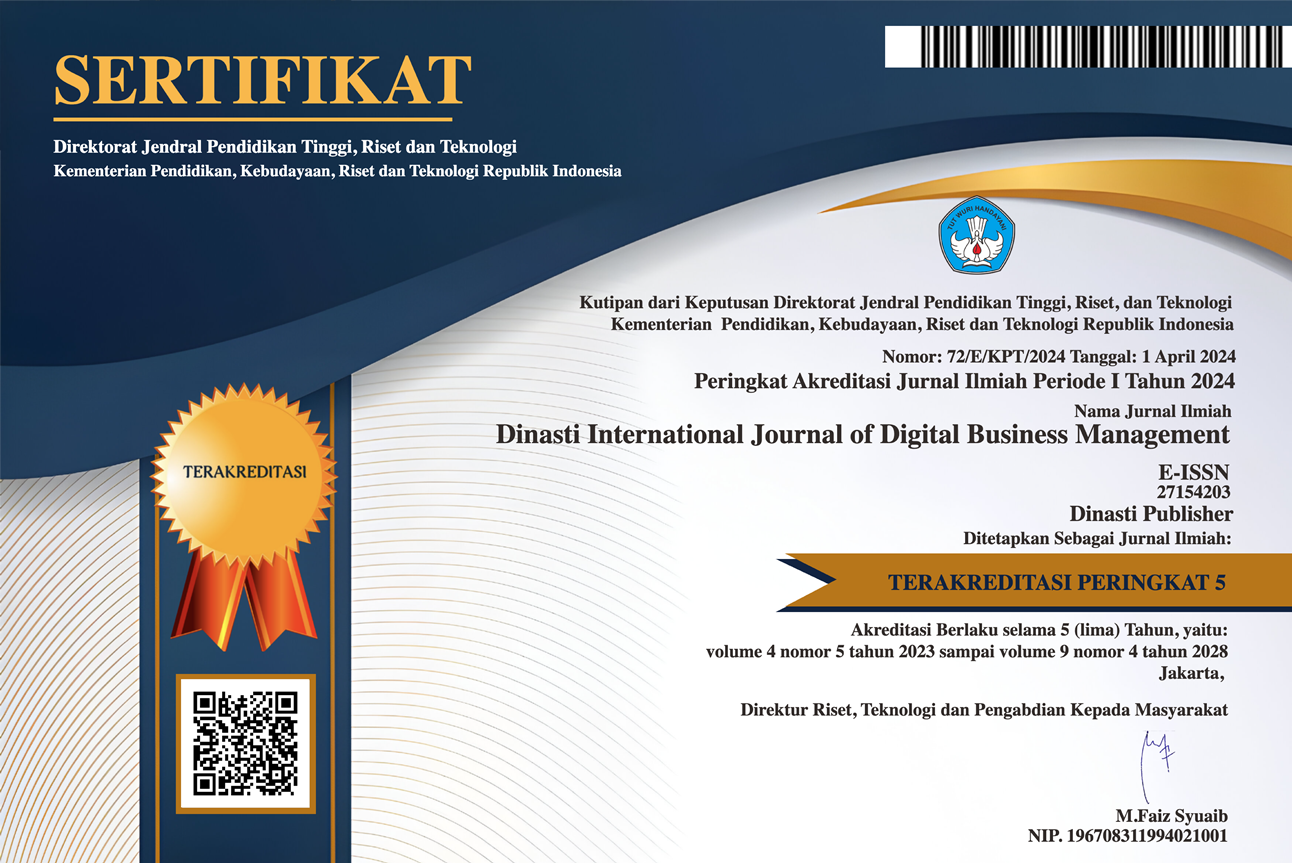

- The author acknowledges that the Dinasti International Journal of Digital Business Management (DIJDBM) has the right to be the first to publish with a Creative Commons Attribution 4.0 International license (Attribution 4.0 International (CC BY 4.0).

- Authors can submit articles separately, arrange for the non-exclusive distribution of manuscripts that have been published in this journal into other versions (e.g., sent to the author's institutional repository, publication into books, etc.), by acknowledging that the manuscript has been published for the first time in the Dinasti International Journal of Digital Business Management (DIJDBM).